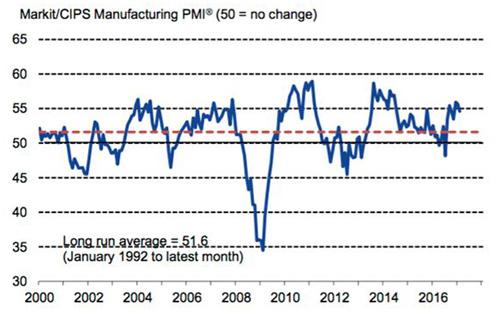

The UK manufacturing sector experienced a rise in production and new orders during February according to the Markit/CIPS UK Manufacturing Purchasing Managers Index.

Although rates of expansion slowed, they remain well above the long-term average, with demand rising in both the domestic and overseas markets.

Overseas demand was particularly strong because of the continued weakness of the sterling exchange rate, the Index reported.

Growth remained solid across the three product categories – consumer, intermediate and investment goods – with the steepest increase seen in the latter.

The ongoing upturn meant manufacturers maintained a positive outlook. Almost 50% expect output to be higher in one year’s time, compared to only 6% anticipating a decline.

Optimism was linked to forecasts of improved demand, increased capital investment, company expansion plans and new product releases.

Business confidence underpinned further increases in employment and purchasing activity during February.

Job creation was registered for the seventh consecutive month, with headcounts rising at SMEs and large-scale manufacturers. Purchasing activity increased at an identical rate to December’s two-and-a-half year high.

Rob Dobson, senior economist at IHS Markit, which compiles the survey, said: “The latest PMI signals that the UK manufacturing sector continued its solid start to the year.

“The survey is signalling quarterly manufacturing output growth close to the 1.5% mark so far in the opening quarter which, if achieved, would be one of the best performances over the past seven years.

“The big question remains as to whether robust growth can be sustained or whether it will continue to wane in the coming months.”

He added that the slowdown in new order growth and a drop in backlogs of work suggest output growth may slow further. However, elevated business optimism, continued job creation, a recovery in export orders and rising levels of purchasing all suggest that any easing will be only mild.

Dobson added: “On the price front, input costs and output charges are still rising at near survey record rates.

However, the recent easing in both suggests that the impact of the weak sterling exchange rate on prices is starting to subside, providing welcome respite with regards to pipeline inflationary pressures.”

For SMEs, business growth can be an opportunity and a threat, as the delicate balance of cashflow can be affected by the investment requirements of meeting new orders.

Andy Hart, head of Investec Asset Finance Group, a specialist lender providing asset finance through commercial finance brokers to UK SMEs, said: “We help SMEs more effectively manage their cashflow. Our own data supports today’s survey, showing year-on-year growth of 9% in the manufacturing sector, after a very strong finish to 2016.

“But at a time when cost pressures will be adding up for SMEs, now is the time to revisit how best to manage finances and cashflow. Businesses need to consider asset finance to help them grow with the benefit of fixed periodic payments rather than paying with upfront cash or an overdraft."

Data Collected - February 10-23

Markit / CIPS UK Manufacturing PMI

Source: IHS Markit