New business volume in the equipment finance sector rose by 18% in June compared to the previous month’s total of $7.7 billion, according to figures from the Equipment Leasing and Finance Association’s (ELFA’s) monthly leasing and finance index (MLFI-25).

The index, which reports economic activity from 25 companies representing a cross section of the sector, showed their overall new business volume for June was $9.1 billion, down 7% year-over-year from new business volume in June 2017. Year to date, cumulative new business volume was up 4% compared to 2017.

Kris Snow, president, Cisco Capital, said: “The overall equipment financing industry activity has been strong during the first six months of 2018. In the technology sector, customers continue to shift their buying behaviors toward pay-per-use models, cloud-based models and bundled solutions that may include hardware, software and services. As a result, we expect captive finance companies to grow in importance as a strategic underpinning for business and economic growth throughout the remainder of the year.”

ELFAs’ figures show receivables over 30 days were 1.4%, down from 1.6% the previous month and up from 1.3% the same period in 2017. Charge-offs were 0.33%, up from 0.31% the previous month, and down from 0.38% in the year-earlier period.

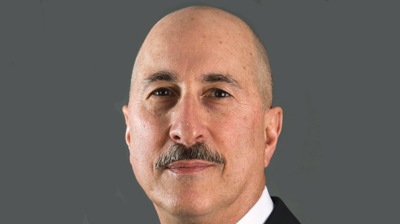

Ralph Petta, ELFA president and CEO (pictured above), added: “Most sectors of the equipment finance industry are performing well, as the economy’s underlying fundamentals continue to hold up in the face of slowly rising interest rates. A strong corporate earnings season and continued strength in the labor markets create a positive environment for capex spending. Hopefully, potential disruption in the global supply chain created by frictions with our trading partners does not upend this positive scenario.”