For several years now, presentations on digital technologies have dominated the agenda at asset finance industry conferences as well as being a key discussion point in many boardrooms.

The ability to provide modern tools for customer or intermediary self-service along with finding improved ways to make better and more efficient business decisions are notable requirements for IT investment today.

Recently, Artificial Intelligence (AI) has taken centre stage and is pushed from many quarters.

At the same time, it can be hard to understand exactly what it is, and harder still to determine how it can be applied specifically to your business and bring material value.

I am going to give my perspective on why AI has had its recent prominence, demystify it a little and explain how any asset finance company, not just the largest, can take pragmatic steps to applying AI in value-adding ways.

I’m not a robot

You may not be aware of it but over the years, every time you have registered to various websites and gone through the process of confirming yourself as a living person, you have been helping correct the scanned text from the Google Books project, identify house numbers for Google Street View or have been labelling image data to train Google’s driverless car project and a number of other machine learning datasets.

The fact Google went to such lengths demonstrated that computers still needed help from humans to tell them what the ‘right answer’ looked like. At least, until they didn’t.

One developer was able to use Google’s own machine learning tools to beat the system in just 40 lines of code, automatically identifying the correct elements of the image and clicking on them. More on those tools later.

Another high-profile achievement for AI occurred in late 2017, when Google’s DeepMind division saw its AlphaZero program defeat the world’s best chess engine, already far stronger than any human chess player.

The achievement was much lauded since the program was provided simply with the basic rules of chess and otherwise ‘learnt’ the game by playing many millions of games against itself over four hours.

It is undoubtedly the case that the support DeepMind received from Google Cloud infrastructure and in particular the launch in May 2016 of its hardware dedicated to machine learning tasks, was critical to AlphaZero’s success.

We are clearly in a time where machines now have the power to perform tasks previously thought impossible. You can now search your photos using text, have increasingly sophisticated conversations with your phone’s digital assistant, see live in-situ translations of foreign language text in your phone’s camera view and hail a self-driving taxi.

Equally important, cloud providers such as Amazon, Google and Microsoft are providing the infrastructure and the tools to apply this AI technology in increasingly easy and more accessible ways.

Defining artificial intelligence

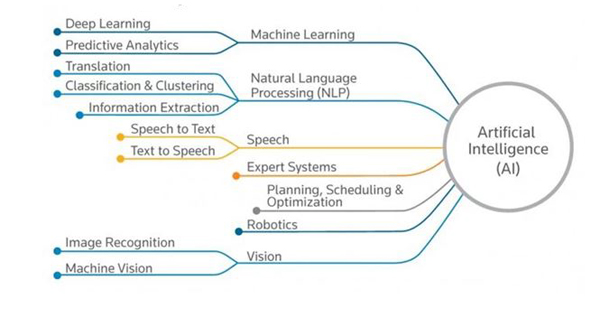

AI is the computer simulation of certain human intelligence processes. These processes include learning (self-determination of information and rules for using that information), reasoning (applying rules towards a particular outcome) and self-correction.

As the diagram below illustrates, Artificial Intelligence groups together a number of sub-disciplines, each focusing on different aspects of simulated human intelligence processes.

Application of AI in asset finance

A case could be made for many of these sub-disciplines being useful to various aspects of the business of asset finance. However, it is the area of machine learning and predictive analytics that has received significant focus in our industry of late.

Machine learning approaches to fraud detection, conversational agents, personalised business processes and cyber security are just some of the areas that asset finance companies are investing in to improve customer experience and protect data and profits.

Data is increasingly accessible. Consequently, the opportunity to understand meaning in that data and make (or augment) decision processes is growing all the time.

Many of the major cloud service providers now provide machine learning environments that can be applied readily to data without expert AI knowledge being required.

Of course, the more expertise you have, the better the results will be, but limited use cases can be delivered successfully and bring real value to your organisation. Let’s look at an example.

Case study - document classification

One of the challenges presented to me by an equipment finance company COO was how to make the inbound document process more efficient. Documents come into an organisation through several channels and for different purposes.

Historically, scanning paper documents and performing Optical Character Recognition (OCR) has been hit and miss, making anything but very tightly controlled scanning of text in a known template pretty much impossible. However, with the new class of machine learning-powered computer vision services, things have got a lot better. But that’s not all.

We can now train a machine learning model to classify the document as well, determining what type of document it is (invoice, settlement request, complaint, signed contract, etc.).

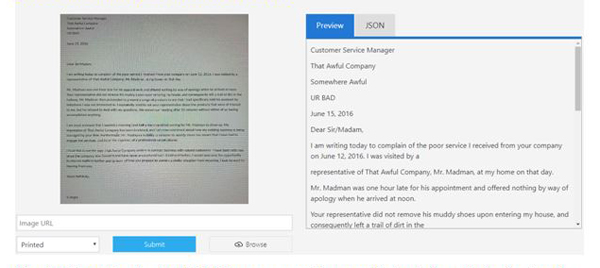

You can perform the following steps to see just how powerful this technology now is. Take a photograph of an example complaint letter and upload it to Microsoft’s Computer Vision test page.

The text is extracted with high accuracy. Along with text already in electronic form, such as emails, the document information is now available for analysis to determine its purpose.

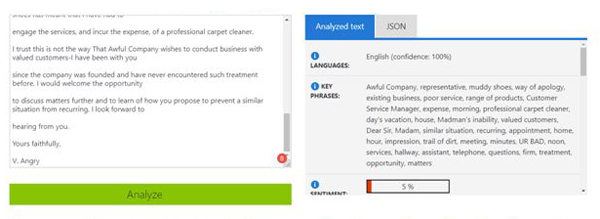

One such analysis can be seen with Microsoft’s Text Analytics which determines whether the sentiment of some text is positive or negative.

Running our recently extracted text through this service reveals its overwhelmingly negative sentiment.

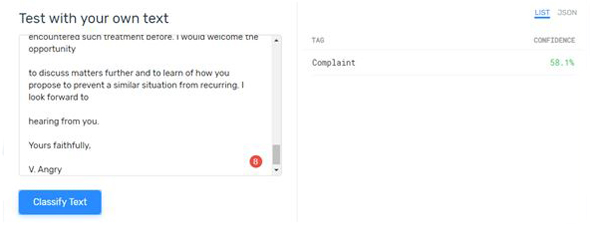

However, things get more useful when we build a machine learning-based 'Classifier'.

It’s easier than you think. Using tools such as MonkeyLearn’s classifier you can use sample documents to train it to recognise different document types.

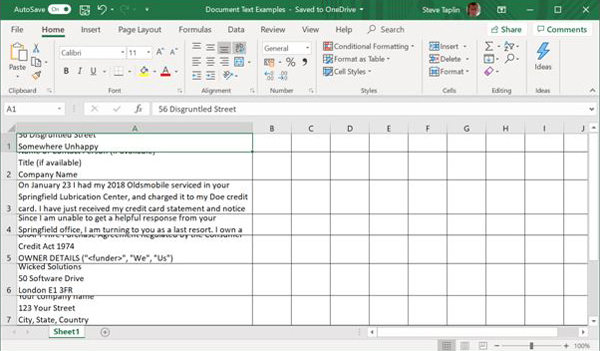

Obtain multiple samples of each of the different types of document that you wish to classify and extract their raw text (take a photo of them and use the previous Computer Vision step if you wish). Now create an Microsoft Excel document with the entire text of each sample placed in each successive row.

Next, upload the Excel file to MonkeyLearn and, using its easy-to-use wizard, start training it to recognise the different document types by tagging them.

Then, when you run your new machine learning-based classifier for new documents, it will determine to a degree of confidence what type of document it is.

All of these techniques can be combined by any decent software developer into an automated process that can then route the document to an appropriate person for handling using your preferred business process management (BPM) solution.

Better still, extract the meaningful data from the document and, based on its context, handle it automatically.

For example, recognise a trusted dealer’s settlement request and send them an email with the settlement details, all without any human touch.

Conclusion

As the 'I’m not a robot' test shows, along with the feats of the DeepMind algorithm applied to chess, machines are now at the stage where they are performing increasingly reliably in certain contexts, previously only achievable through manual, human operation.

Artificial intelligence, and machine learning in particular, has received a massive shot in the arm as a result of the superpowered hardware employed by the major cloud service providers. Better still, they have provided us with the tools in ever accessible ways.

There are many other use cases where machine learning can be applied, such as social media monitoring, chatbots, anti-fraud, augmented data credit checking, personalised user experience, adaptive business processes and more. The value is clear to see and quantify. Exciting times.

* Steve Taplin is co-founder at Finaptix, which advises clients on all aspects of implementing and operating software systems for their businesses, from digital strategy, system selection and technical delivery to change management and ongoing support.