The UK chancellor’s £12 billion action plan in March allowed strong elements of a supply-side palliative care to the societal and industrial lock-down caused by the Covid-19 pandemic.

A range of schemes have been devised to support businesses and funders including the Coronavirus Business Interruption Loan Scheme (CBILS), Term Funding for SMEs (TFSME), Contingent Term Repo Facility (CTRF) and the Covid Corporate Financing Facility (CCFF).

The TFSME and the CCFF were inaccessible to UK independent and non-bank funders. Nor did it appear at first was CBILS, which had been designed to support smaller businesses from losing revenue and their cash-flow being disrupted.

Moreover, CBILS was limited to new borrowing and as such was not able to be used by firms to assist with their existing obligations. Allowing CBILS to be used on existing obligations would have meant firms could secure payment holidays and support without which they may default and their funders themselves eventually requiring support.

Simon Goldie, Head of Asset Finance at the Finance & Leasing Association told International Asset Finance Network that subsequent lobbying of the UK Treasury had confirmed that the CBILS’ threshold had been raised above a £45 million turnover. “The other point we raised,” he added, “was around perhaps grandfathering existing customers into the scheme who wouldn’t have needed an Enterprise Finance Guarantee (ERG) – but now might need it and thinking of refinancing. So we’ll wait and see if the government and the British Business Bank (BBB) take that on board.”

Speedy accreditation needed

However, with lockdown mandated from 23 March speed of application became an urgent priority. Goldie said: “We have argued that the accreditation process needs to be as quick as possible so if a funder is regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA) this should be taken into account. We have been assured by the BBB that they are doing everything they can to speed up the accreditation process.”

At the same time the FCA proposed a range of temporary banking measures to support consumers – these included a temporary payment freeze on loans and credit cards to come into force on 9 April. The FCA and the PRA jointly announced an intention of flexibility in regard to the Senior Managers and Certification Regime.

On mainland Europe, the European Banking Authority (EBA) provided similar clarity of measures to mitigate the impact of the pandemic on the EU banking sector. The guidance provided details on using flexibility in supervisory reporting and measures to prevent money laundering and terrorist financing.

FinTech companies upbeat

On a brighter side, deVere Group reports a 72% increase in FinTech app usage in Europe since the pandemic hit. At a time when many sectors of the economy are being badly affected, the rise in app adoption and usage is good news for the FinTech industry.

Indeed, economic downturns can result in many great innovations. Some of the world’s current great tech unicorns were born during the global financial crisis a little over a decade ago.

On 6 April DBRS Morningstar’s Macroeconomic Update concluded that the evolution of the coronavirus pandemic in Europe and the effectiveness of the policy responses will be crucial for the economic recovery.

A weak starting point

It stressed that the EA economy as a whole is facing this new challenge from a weak starting point, following slowing growth in 2019. Some indicators have started to show the severity of the shock. EA consumer confidence took a dip in March and EA economic sentiment fell below its long-term average for the first time since January 2015. Both the manufacturing and services sectors are being hit.

In the UK, the data show a weak background moving into the coronavirus shock period that suggests even with support measures, the UK is heading for a sharp economic contraction. It added: “Uncertainty is still hitting confidence.

Uncertainty increased with the Brexit referendum in 2016, and is now increased in 2020 with the impact of the coronavirus, as well as the ongoing lack of clarity around the UK's future relationship with the EU.”

However, it reported that the response of the UK authorities has been timely and targeted with fiscal measures amounting to £60-70 billion or 3% of GDP. The Bank of England has also responded and DBRS Morningstar predicts these measures will cushion the blow during shutdowns and, in time, work to support a steadier recovery.

Demand side of the industry looking grim

Although the supply side of the industry has been addressed by the UK government, the lockdown of industry non-essential to day-to-day existence is proving catastrophic.

New-car registrations in the UK plummeted 44.4% year-on-year in March. Accordingly, the seasonally-adjusted annualised rate (SAAR) has fallen to below 1.4 million units – lower than the annual registrations recorded at the time of the 2007-8 global financial crisis.

Autovista Group’s senior data analyst Neil King said: “As the global COVID-19 pandemic continues, current dominating questions for the automotive industry are: how quickly can the coronavirus pandemic be contained; how long will the automotive sector suffer disruption; and how quickly can the market recover?”

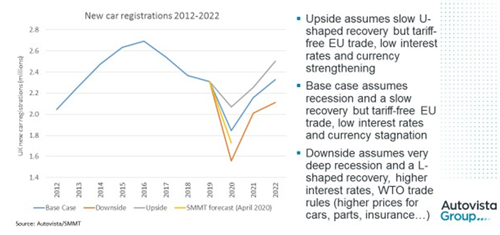

Two contraction scenarios

Given the dramatic impact of the pandemic on the automotive sector in the UK and globally, the Autovista Group base-case forecast for 2020 has been revised downwards to a 20% contraction, from 3% previously. In this base-case scenario, disruption is expected to continue for about six months.

“In our base case-scenario, I foresee a loss of 600,000 registrations in the coming months but not all of this pent-up demand will be recovered by the end of the year and hence the decline to 1.84 million registrations in 2020, 20% down on 2019,” explained King.

In a downside scenario, disruption to new-car registrations is assumed to continue for most of 2020, resulting in a loss of some 750,000 registrations and limited opportunity for recovery of the losses later in 2020. The forecast for this worst-case scenario is for UK new-car registrations to fall to 1.56 million units, down 32.5% on 2019.

In an upside scenario, disruption to the UK automotive sector will be more short-lived, with a significantly lower loss of registrations and much more opportunity to recover the losses later in the year. In this scenario, fewer than 250,000 registrations will be lost and the forecast is for 2.07 million registrations in 2020, down 10.5% on 2019.

UK new-car registratons forecast

Source: Autovista Group/SMMT

The March new car registration total is the lowest figure for the month of March since the UK moved to a bi-annual number-plate system but even more dramatic declines have been reported in other European markets, where lockdown measures came into force earlier.

In the first wave of European new-car registrations data published for March, the respective automotive trade associations in France, Spain and Italy report that registrations have fallen by more than two-thirds compared to March 2019.

Questions for the immediate future

The UK Finance & Leasing Association’s members concluded 2019 with some encouraging figure work. They reported a 6% growth in asset lending to reach a record annual total of £35.7 billion. In addition, consumer car finance held steady throughout the year providing finance for over 2.4 million cars. The value of new and used cars financed totalled £38 billion – a 3% increase over the previous year.

FLA members will shortly be reporting a very different set of figures for Q1 2020.

With early reports from the US revealing an alarming increase in auto finance defaults, especially in the sub-prime sector, the inevitable fall in turnover will inevitably skew default ratios adversely, irrespective of customary high underwriting standards.

Indeed the impact of the coronavirus situation on individual finances could mean that the post-crisis motor finance sector could potentially look quite different.

Paul Burgess, CEO of Startline Motor Finance explained: “Whenever things return to relative normality, we’ll be looking at a UK working population, both employed and self-employed, whose personal financial situation will not be as simple to read as previously.

“Motor finance companies are very likely to have to think again about how they assess individual creditworthiness and we may well find that the market segmentations that we use now such as prime, near-prime and sub-prime have shifted.”

Additionally, despite unprecedented government intervention, there is likely to be a fairly steep rise in unemployment. Burgess stressed: “We’re seeing predictions of the unemployment rate doubling from its pre-crisis rate to about 7%, which is clearly a significant jump. The perception that employment has become more precarious will also create difficulties.”

The pandemic is forcing financial services companies throughout the world to review their remote working capabilities. Could working from home become the new norm for auto finance and asset lenders?

Most asset and auto finance lenders believe, like the Queen, that “while we may have more still to endure, better days will return”. Some industry observers believe that a more collegiate approach to a range of aspects of our industry will be required in future – ranging from new ways of credit assessment to new defences to cybercrime .

International Asset Finance would like to hear views from our readers on how best to tackle the challenges of the pandemic – and how the “better days” for our industry are likely to be achieved once they arrive.

Send your thoughts to Brian Rogerson, Consultant Editor brianrogerson@assetfinanceinternational.com