The asset finance industry has undergone some of the most fundamental changes in its history over the past year and new risks are now emerging as finance providers focus on growth in a post-pandemic era, as Adam Kobeissi, innovation director in CGI UK’s Financial Services Practice, explains.

When COVID-19 emerged and global business structures were disrupted, it led to an unprecedented adoption of digital processes to maintain customer contact and keep businesses moving.

In what has been called the world’s biggest work-from-home experiment, tens of millions of people pivoted to digital solutions, such as Microsoft Teams, Zoom and Slack, to maintain communication. New digital channels were developed, with a particular focus on enabling customers to communicate with finance providers and their distributed workforce, to maintain service levels and remain compliant.

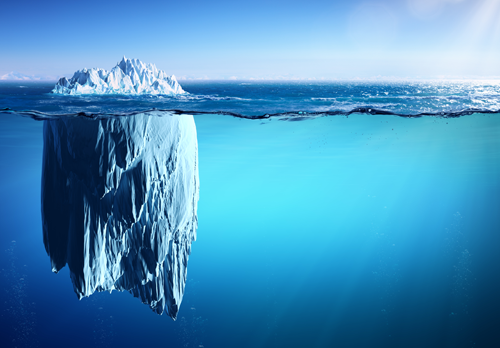

This search for solutions to an immediately visible problem was necessary, but flawed, because by responding solely to what was in front of them, companies often failed to consider the hidden threats or consequences of their strategies, creating a ‘digital iceberg’.

The impact of short-term, siloed thinking may be hidden in the calmer waters of the world under lockdown, but as economies emerge from the crisis and business volumes increase, the sheer scale of the challenges will become apparent.

Digital solutions have delivered the rapid, touch-free experience customers increasingly expect in some areas, but this could flood remaining legacy systems with work that cannot be processed with the same speed and efficiency, which will undermine the success of digitalisation initiatives.

Digitalisation delivers the most valuable benefits when bold thinking is applied end-to-end with a focus on operational outcomes. Touchless service design should aim to deliver automation across an entire customer journey, from receipt of incoming demand through to completion of service request, delivery of management information and exception reporting.

This requires three development stages to embrace and deliver digital change:

- Think big – develop a bold end-to-end vision and strategy to set a course for the digital future of the business.

- Start small – Deliver changes with a sprint philosophy and rapid iteration, so that value is delivered quickly while the business remains responsive to developing market needs.

- Scale quickly – Consolidate success with rapid expansion of value-added services to maximise the benefits to customers and the business.

In developing a bold strategy for intelligent automation, the asset finance market faces a common set of challenges, namely delivering digitalisation to meet customer expectations, achieving a consistent level of compliance, driving operational excellence and modernising legacy systems.

As these challenges are all interlinked, it is vital to set a course for the whole business that considers the full range of changes required, even though they will not all be tackled at once.

This ensures the whole company remains on the same strategic heading as it responds to challenges ahead and avoids development teams working in silos to deliver success for one department, only to generate problems for executives elsewhere in the delivery chain. For example, pre-approvals for credit can transform origination levels and help sales teams achieve initial success, but if the subsequent underwriting processes remain embedded in legacy systems and administration-intensive processes, then initial customer promises could be broken and clients may look elsewhere for a more consistent, dependable supplier.

Customers may want digital solutions, but not at the expense of service levels, so it is important to engage with them early about development strategies along with employees as part of a six-stage approach.

- Engage Stakeholders – Secure customer and staff investment at the outset by obtaining their expert opinions. A well-designed approach empowers employees as well as clients with easy to use, intuitive systems that deliver automation to drive efficiencies.

- Assess Service – Conduct a thorough end-to-end review to establish the potential for digital transformation, covering areas such as process, channels, and work allocation.

- Design Processes – Define an enhanced end-to-end service where repetitive, manual, low-value processes are automated based on business rules and compliance requirements, while high-value personal services are enhanced.

- Transform Service – Build, test and deploy, with focus on rapid, small scale initiatives that quickly scale and iterate, through close cooperation with staff, customers, and suppliers.

- Embed Change – Fine-tune service operations, capture exceptions and amend service design where required to maximise adoption during roll out and secure required business outcomes.

- Review and Iterate – Provide ongoing support in the long-term, regularly reviewing performance against initial design targets to sustain or increase go live business benefits.

While companies tend to approach digitalisation initiatives with a customer experience mindset, this also encourages a siloed approach. As the above process shows, the focus should be service experience overall, for both the employee and the customer, to identify how well digitalisation enables them to work together for a successful outcome during the life of an asset finance agreement, from origination to disposal.

The complexities of delivering this digital future will rely on partnership and collaboration to cope with the hidden depths of the digital iceberg, while maintaining an overall strategic course.

At CGI, we drive digital change together with our clients using a balance of data, process and technology enhancements directed by a well-planned strategy that charts a course for the whole business.

By building the right foundations, with measurable business objectives, we can establish a clear direction for developing business critical processes using specialist IT delivery and change management expertise.

This allows the best technology to be applied in the most efficient way to deliver the greatest benefit for the business as part of an overarching business strategy.

The pandemic has created a unique environment where asset finance providers can consider the future of their approach to market and embed change that will deliver business benefits for decades to come.

However, success will only be achieved by companies that recognise the true scale of the digital iceberg and respond to the hidden challenges they face through a strategic, partnership-led approach.

* Adam Kobeissi (pictured) is an innovation director in CGI UK’s Financial Services Practice, leading in asset and auto finance. He has more than 20 years’ experience in both technical and commercial roles at the forefront of technology and is an expert in digital change, having worked across the financial services and retail sectors to drive innovation.

* In the asset finance sector, CGI provides digital customer lifecycle solutions that help clients achieve lean business operations and greater customer intimacy. Founded in 1976, CGI is among the largest IT and business consulting services firms in the world. Operating across the globe, CGI delivers end-to-end capabilities, from IT and business consulting to systems integration, outsourcing services and intellectual property solutions, helping clients achieve their goals, including becoming customer-centric digital enterprises.