The UK used vehicle market saw sales levels drop by around 80% during the lockdown, as dealers closed their doors and turned to online sales to encourage business.

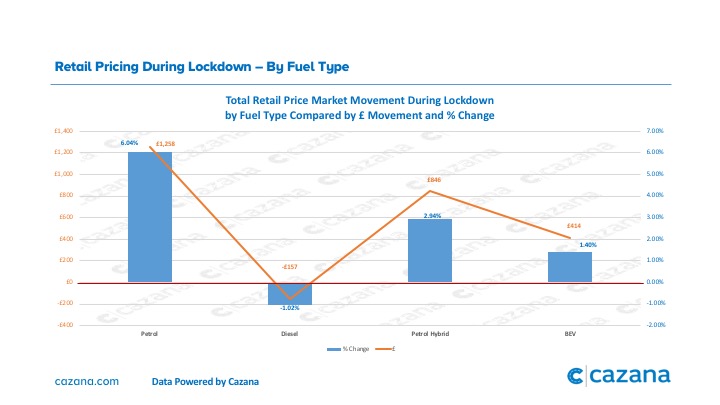

According to automotive insight provider Cazana, the retail price increased for all but diesel-powered used cars, and the price decline for diesel cars came in the high mileage ex-fleet vehicle profile. This can be seen in the chart below, which tracks the retail price movement from March 23 to May 25.

Total retail price market movement during lockdown by fuel type - compared by £ movement and % change

Cazana claimed that a surge in pricing such as the one seen during lockdown can often be indicative of good consumer demand, and perhaps a shortage of stock.

Considering that transactions have been continuing – albeit at a greatly reduced rate – during the lockdown and manufacturers have ceased production, stock levels are likely to have dropped. Therefore, Cazana pointed to the logical conclusion that there may be wholesale demand as the auctions begin to resume business.

However, the complete auction and logistics supply chain is estimated to take up to four-six weeks to resume operations in full.

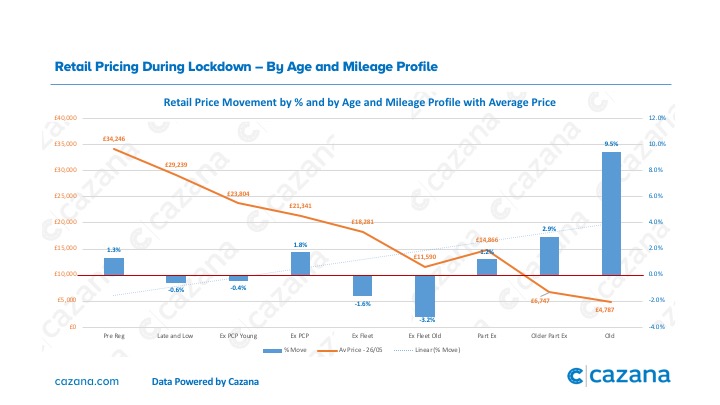

As displayed on the graph below, five age and mileage profiles show an increase in prices and four show a decline. According to Cazana, the two main areas of concern are the ex-fleet cars at three and four years old which have dropped in price by 1.6% and 3.2% respectively.

Retail price movement by % and by age and mileage profile with average price

So far, the data from Cazana shows that there has been an overall upward pricing trend during the lockdown period, which hints at confidence in the market and some level of retail consumer demand. This is at odds with the results from other valuation data providers which were markedly more negative, suggesting downward pricing moves of up to 5% on their monthly output.

Cazana pointed out that many providers base their decision process on manually editing a pot of data which, by their own admission, had shrunk in volume to 20% of the pre-lockdown levels.

Furthermore, a forecast that car prices could be as much as 7% lower at this point next year appears to be unfounded given the low levels of wholesale data available and certainly contradicts the positive outlook that the vast majority of dealerships and advertising portals are expressing.

Founded in 2012, Cazana provides global automotive insights based on the real-time data on millions of vehicles for sale across more than 40 countries worldwide. The company offers this data to manufacturers, dealers and finance and leasing companies to detail residual value risk and changing vehicle prices for them.