As many leasing businesses start to approach their September or December year-ends, finance directors, boards and external auditors will be having to make difficult judgements about accounting impairments.

Although this year will bring unique challenges, it may still be useful to consider where companies sit historically in relation to their peers.

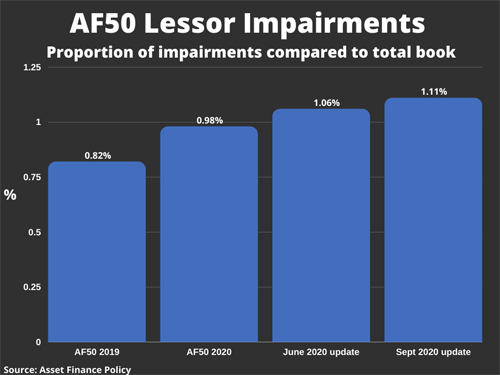

Within the UK Asset Finance 50, the industry ranking survey published jointly by Asset Finance International and Asset Finance Policy and sponsored by Alfa, we reported on the average accounting impairments balance as a percentage of total book.

As shown in the chart (below), the weighted-average level of impairments increased from 0.82% in the 2019 edition of the Asset Finance 50 to 0.98% in the 2020 edition. Since then, the average increased to 1.06% using data available until June 2020, and further to 1.11% for data available until the start of September.

A total of £334 million was impaired across 38 companies reviewed in their September data, up from £312 million in June and £298 million in this year's AF50 published in March.

This analysis is based on data taken from published annual reports, so for the latest update, annual reports for periods ending up to March 2020 were used.

Where possible data is only for accounting finance leases (i.e. including hire purchase) but for some companies it includes other lending products. Operating leases are excluded.

The increases will reflect, to some extent, the first-year adoption of IFRS 9 by some companies, which tends to result in slightly higher impairments.

Further details of the analysis is available from Asset Finance Policy, including a company breakdown for the 38 firms for which data was available, along with analysis of write-offs as a percentage of book and the ratio of impairments to write-offs.