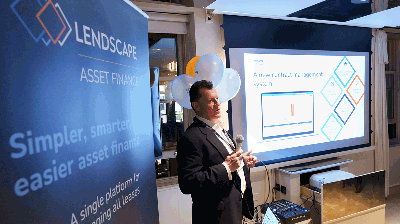

HPD Lendscape’s celebration of the launch of its lending solution, delayed by COVID-19, went ahead last week at the Groucho Club with asset finance lenders attending in force. The launch event not only publicly announces the company's interest in the asset finance market but reveals their intention to differentiate from the incumbents with a modern, progressive back-end solution.”

HPD Lendscape best known for its supply chain and invoice finance solution has been building its capability in asset finance over the last two years. In October 2019 they recruited long-standing asset finance technology heavyweight Steve Taplin as managing director. Steve brought with him industry colleagues Michael Mayes and Ralph Neuff adding lots of asset finance muscle to the Lendscape global operation.

Lendscape Asset Finance was officially launched in January 2022, and announced their first asset finance client Compass Business Finance, a mid-tier lender providing a range of financial products including leasing and loans for UK businesses.

Before that Lendscape had used downtime in the pandemic to systematically research the market and it was then that they developed their focus on a back-end system that can deliver in Taplin’s words ”simpler, smarter, easier asset finance”. Whatever that actually means, they clearly see the crowded front-office tech market as being more attractive for generalist tech companies because it requires less specific industry expertise but also far less opportunity due to what they perceive as a lack of consistency in requirements between lenders.

Taplin’s USP lies in identifying real opportunities for technology to deliver value for asset finance companies, without the hype associated with technology development. This is a skill which he has honed over years working with Tier 1 asset finance lenders worldwide. Taplin is well positioned to find the opportunities to use and apply new tech that can outperform well established market incumbents whose mature product offerings could prove a brake where their complexity slows their ability to capitalise on what is new and genuinely valuable.

The real challenge for Taplin lies in his ability to extend Lendscape’s reach beyond the mid-tier to win a share of the lucrative tier 1’s who will also be seeking to find tech that will drive the next generation of asset finance solutions.

Before that however the business will be seeking to build a track record of success with innovative mid-tier companies – and this is undoubtedly an opportunity for organisations with an appetite to ride the wave of investment, innovation and expertise which is now available to this market.

After years of not too much change at the top – things in asset finance technology may be about to get interesting.