In a speech last week in the US, Andy Haldane, chief economist of the Bank of England, described how industry concentration ratios - the share of sales in a sector that are taken by the largest suppliers - have increased over the past 10 years in the US and (to a lesser extent) the UK, but have now flattened off.

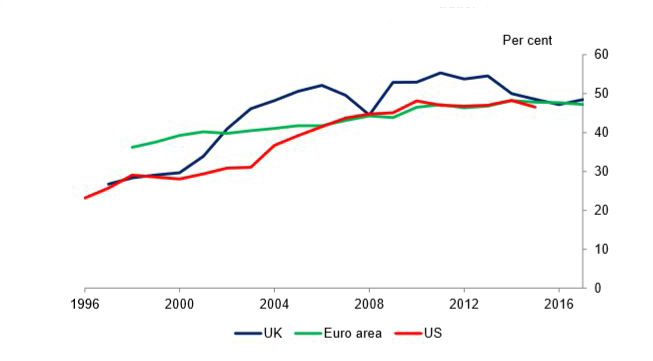

That’s the case across a broad range of sectors, Haldane showed, but it is particularly marked in the banking sector, as shown in the chart below taken from speech.

Banking concentration

Sources: Bank of England, European Central Bank, Federal Reserve Bank of St. Louis and Bank calculations (see notes at end of article)

Haldene’s speech was about the global role of ‘superstar’ globally powerful firms such as Google and Amazon, but his speech raises the question of whether higher concentration levels are an inevitable outcome of the economies of scale and scope available to the largest, technology-enabled, firms.

Concentration levels in the UK asset finance industry seem well-below those for general banking.

According to the 2018 edition of the Asset Finance 50 (which I produce with Asset Finance International) the 10 largest lessors held 58% of the UK business equipment and fleet leasing market, up from 57% in 2017 and 54% in 2016.

Even with this increase in concentration, the top five firms held only 38% of total market volume last year, considerably lower than the corresponding figure for general banking of around 48%.

There are currently 50 to 60 significant firms in the market, if we measure this by firms having book values of £50m or above.

The number of active firms has increased in recent years, with a stream of new entrants competing for SME lending introductions from brokers.

The asset finance broker channel itself remains highly diverse and unconcentrated.

Notwithstanding some high-profile acquisitions of top-20 companies, including by several investment firms with deep knowledge of the leasing sector, at least 80% of broker channel volume remains spread fairly evenly across over 500 smaller firms.

Further consolidation seems be slowing as the firms are too small, and too reliant on one or two key people, to make them viable acquisitions targets.

This diverse and competitive asset finance market might seem a good thing for customers.

Reduced competition is generally associated with higher margins (and often prices) - although Haldene presented data showing that net interest margins for banks have actually remained broadly flat over the past 10 years, suggesting this relationship might not be so clear-cut in financial services.

On the other hand, higher concentration can deliver benefits to consumers.

Larger companies find it easier to invest in technology to achieve operational efficiency, to attract and retain talented staff, and to secure external investment - all important factors in delivering the best value to lessees.

Yet, 2018 hasn’t so far been a year of big industry consolidation announcements. Hitachi bought Franchise Finance, whilst LDF was sold to US investment firm White Oak. Construction Plant Finance was formed, a joint venture between SKM Asset Finance Ltd and Corporate Asset Solutions.

Does this suggest the rate of increasing concentration is flattening off, as Haldane observed to be the case across many economic sectors?

That seems unlikely. Asset finance is still relatively unconcentrated, whilst growing use of increasingly-expensive technology together with the higher burden of regulatory compliance increases the attractiveness of consolidation.

Whether that will come through growth of existing firms, more acquisitions, or the start of a round of mergers or joint ventures, it doesn’t feel like the leasing industry will look the same way in 10 years’ time.

* Julian Rose is director of consultancy at Asset Finance Policy. He is author of the A to Z of Asset Finance and Leasing and of a range of Apex Insight consumer credit market reports, including a new report on the used car finance market.

** Notes: Data refer to banking sector assets of the five largest institutions in each region as a share of total banking sector assets. UK banks are all UK resident monetary financial institutions (MFIs). These data cover only the UK assets of the MFIs. As such they differ from the institutions' own published accounts that will comprise the global assets of the group. Euro-area data prior to 2006 are constructed using data for the Netherlands, Germany, France, Italy, and Spain holding the share of these countries relative banking sector sizes constant, at their 2006 level. This is due to data availability limitations pre-2006.